Cashback betting

If you enjoy the relaxing fusion of casino slots and a luxurious vacation, Mega Fortune is for you. With 5 reels and 25 paylines, this NetEnt jackpot slot has an RTP rate of 96 https://gamble-online-aus.org/.6%. Playable from 25p a spin, it comes with free spins and a multiplier up to 5x.

Please gamble responsibly and only bet what you can afford to lose. Betting sites have a number of tools to help you to stay in control such as deposit limits and time outs. Read more in our guide here. If you think you aren’t in control of your gambling then seek help immediately from GambleAware or Gamcare. Advice and support is available for you now.

If you like to play progressive jackpot slots, you are spoiled for choice with the outstanding selection of jackpot slots available. While these insanely fun games all offer excitement, the chance to win a 7 or 8-figure jackpot is certainly real.

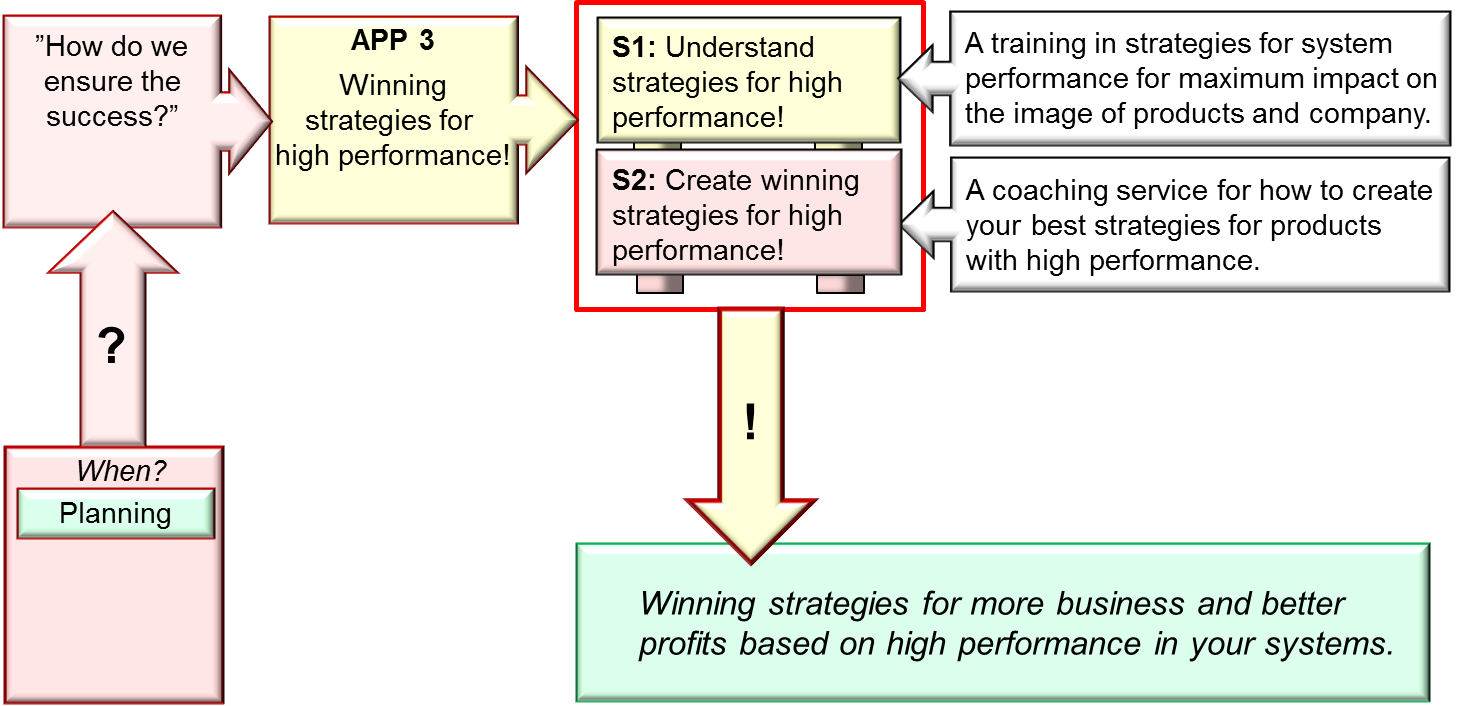

Winning strategies

Strategy is about long-term success; it is not about quick wins – although great if they do happen! The vision has to be clear at every moment of the journey, be consistent and mindful of the market’s ebbs and flows. We often have this view of strategy as a set of slides dusted – off every five years. A strategy needs a set of checkpoints that keeps the business on course, so check it as often as necessary, and certainly following (or in anticipation of) market shake- ups.

Developing a winning aspiration, crafting strategic choices, and building capabilities for success are the cornerstones of a winning business strategy. By following the guidance provided in this blog post, you’ll be well on your way to transforming your organization and achieving sustainable success.

This skin care company’s winning aspiration is to become the leading provider of natural skin care products in the world. To achieve this, they made strategic choices such as focusing on natural ingredients, investing in research and development, and broadening their product line. Their innovative marketing strategies, including leveraging influencers and social media campaigns, played a significant role in their success.

Roger Martin is a bit of a legend in the strategy world. His book Playing to Win, written with former Procter & Gamble CEO A.G. Lafley, is a favorite in business schools. And decades of work consulting with some of the world’s most recognizable companies have cemented his place as one of today’s leading business thinkers. In this conversation, get an inside look at Roger’s approach to business strategy and hear about our newest course, Designing Strategy.

The former follows this rule: If strategy opposes culture, it loses. It will never get traction. The latter speaks to speed and effectiveness. With poor allocation and strategic management, execution will move slowly and its results will meet an insurmountable ceiling.

Convenient payment methods

Evaluating payment processing costs requires considering transaction fees and equipment expenses. Businesses need to weigh these costs against the benefits of offering various payment methods to ensure they are making financially sound decisions.

As in many other regions, digital wallet usage is on the rise in Australia and New Zealand, with Apple Pay, Google Pay, PayPal, and Samsung Pay all popular options. As seen in other regions across the world, consumers in Oceania are consistently switching from cards to digital wallets due to the greater convenience and security they offer.

Cryptocurrencies like Bitcoin and Ethereum have gained popularity as a digital payment mode. These digital or virtual currencies use cryptography for security. They offer anonymity but are subject to price volatility and government regulations.

“For a very long time, businesses were deciding how they wanted to accept payments. But the customer may have specific reasons for choosing a certain payment method and there shouldn’t be any friction by merchants offering a multitude of options.

Merchants will need a new point-of-sale terminal to accept tap to pay transactions in a brick-and-mortar store. Many mobile wallet apps also place transaction limits on their customers—limits that tend to be much lower than most credit card limits. This can put an artificial cap on the size of a customer’s purchase.

To start accepting various payment methods, businesses need to create an account with a payment processor like Stripe, which requires no contracts or banking details. Pay.com provides both no-code solutions for beginners and developer-friendly APIs to accept payments for more complex integrations.